WHY IS IT SUDDENLY COSTING $40.00 (OR MORE) TO FILL UP WITH GAS?

Since the beginning of 2021 inflation has been rising in the United States. Inflation occurs when prices of goods and services rise over time, eroding the value of our money. If you used to buy a tank of gas for $20.00 but now your cost is inflated to $40.00, your dollars are now worth 50 cents when purchasing gasoline. Not all goods and services have risen at the same rate as gasoline. From the beginning of 2021 through July the cost of food at home was up 3.4%, food away from home up was up 4.6%, energy costs up 23.8%, new vehicles up 6.4%, used vehicles up 41.7%, and used pickup trucks were up 100% or more. The overall inflation rate of the U.S. economy through July was 5.4%, the highest U.S. inflation rate in 13 years. In August, inflation settled at 5.3%. Two of the major causes of inflation historically have been supply chain disruptions and the printing of money by the government. Thanks to COVID our country is currently experiencing both of these.

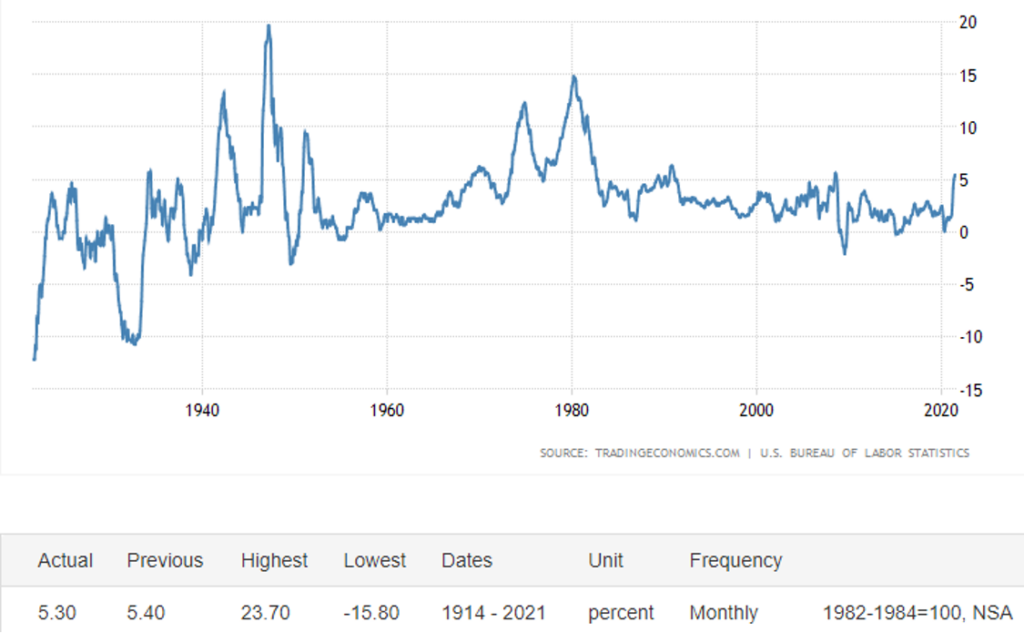

The following charts will help put things into perspective for us:

LONG TERM HISTORICAL INFLATION

As you can see in the previous chart:

- The huge spike in inflation during the 1940’s was due to:

- The U.S. government spending to fight a world war

- Supply chain disruptions as raw materials had to be redirected toward the war effort

- The spike in inflation during the 1970’s was due to:

- The U.S. government operating under huge deficits (debt)

- The U.S. government dropping the gold standard, which historically had backed the value of our currency

- The U.S. government initiating wage and price controls in 1971

- Supply chain issues due to disruption of the oil supply by OPEC

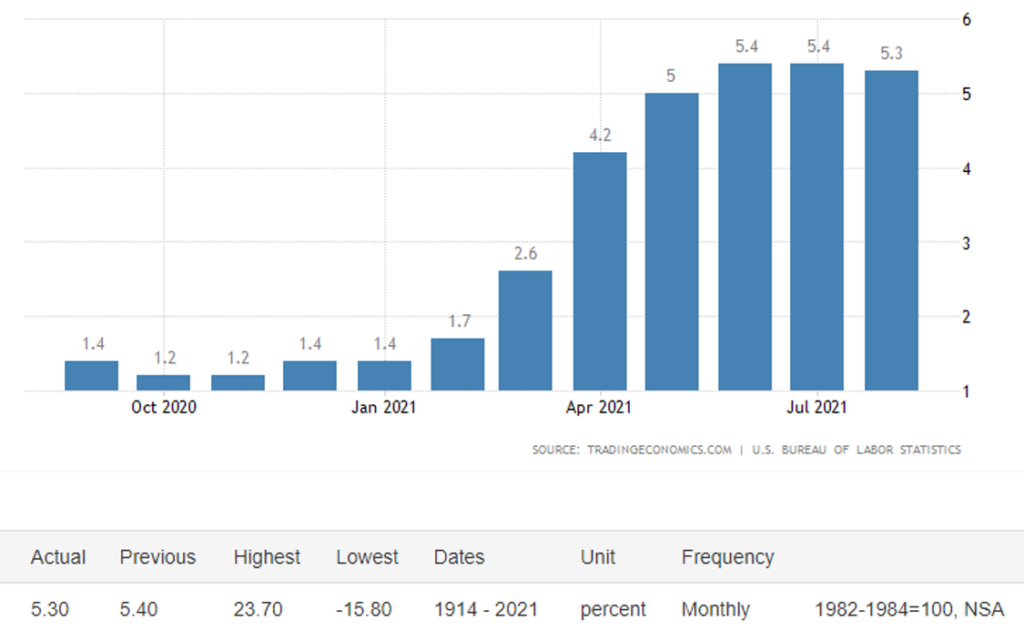

RECENT INFLATION

As shown in the chart, U.S. inflation has been rising quite drastically since January of 2021. Even though July’s 5.4% inflation rate is the highest inflation rate in the last 13 years, most economists seem to agree that a 5.3% – 5.4% inflation is not, in and of itself, a danger. However, many see it as more of a warning.

It’s not really about the current inflation rate. It’s about what has caused it to rise so quickly. The causes are supply chain disruptions due to COVID as well as the fact that our government decided to print money to pay for the numerous programs it has created. As a result, over the last year we have increased the amount of U.S. dollars in circulation by 30%. If we want to try and stop the rise in inflation, one of the best things we can do is to stop printing money.

A 5.3% inflation rate isn’t fatal, but economist say if it gets to 10% or 15% it could create problems. We are hoping to see our government back off of the borrowing and printing of money. Also, as the world gets back to normal, we are optimistic that the supply chain issue will work itself out.

At this time, we have stocks in most of our portfolios, because stocks have historically outperformed inflation over time. Also the managers of our bond funds have the option of including TIPS (Treasury Inflation Protected Securities) in our portfolios as needed. As inflation rises, TIPS rise in value and pay out more interest.

Inflation is a hot topic right now. However, you can rest assured that we, at Financial Professionals, Inc., will always consider inflation as we implement each client’s long term financial plan.

Sources: tradingeconomics.com, Kiplinger.com, Statista Research Department, Professor Jacobson, Economics Professor at Ottawa University